Most business decisions are made under pressure. A client wants an answer today. A project is going off track. Cash flow feels tight. A new hire is needed. In those moments, many leaders default to intuition. They make a call based on experience, instinct, and the “feeling” of what is happening inside the business.

Intuition is not useless. In early stages, when data is limited and speed matters, it can be a powerful tool. The problem begins when the company grows, complexity increases, and intuition becomes the primary decision system. As soon as there are multiple teams, multiple service lines, multiple pipelines, and multiple financial moving parts, decisions made mainly from intuition become inconsistent, slow to correct, and expensive to repeat.

Data-driven businesses are not “cold” businesses. They simply replace guesswork with visibility. They reduce decision risk by seeing patterns earlier, measuring reality more accurately, and aligning teams around the same facts. Over time, this creates a major advantage: better decisions compound into better operations, better customer experience, and better profitability.

What “Data-Driven” Really Means in Practice

Being data-driven is often misunderstood. It does not mean drowning in reports or tracking hundreds of metrics. It means using reliable information to answer important questions with confidence. The goal is clarity: understanding what is happening right now, why it is happening, and what to do next.

A data-driven company builds a habit: decisions are tied to measurable signals. If conversion is dropping, the team can pinpoint which stage is leaking. If profitability is falling, the business can see whether the issue is pricing, cost structure, utilization, or project overruns. If customer retention is weakening, the company can identify where service delivery fails to meet expectations.

In other words, a data-driven company does not remove human judgment. It strengthens judgment by grounding it in reality.

Why Intuition-Led Decision Making Breaks at Scale

Many service businesses run successfully for years on intuition. But the growth phase exposes the limits of that approach. The larger the company becomes, the more expensive mistakes become, and the harder it is to see problems early.

One major limitation is that intuition is not shared. It lives inside individuals. If one manager “knows” what is happening, but the rest of the team does not, the company becomes dependent on that person. When they are absent, overloaded, or replaced, knowledge disappears.

Another limitation is that intuition is often based on partial information. A sales manager may feel that “leads are weaker,” but in reality, the leads may be strong and the problem may be slower response times. A founder may feel that “costs are high,” but the real issue may be project scope creep or repeated rework. Without measurement, teams end up fixing symptoms instead of causes.

Finally, intuition-led decisions can create inconsistent behavior across departments. Each team operates by its own perception of reality. Sales has one story, operations has another, and finance has a third. The business becomes reactive, and leadership spends more time resolving disagreements than improving the system.

The Real Advantage of Data-Driven Decision Making

When decisions are based on shared signals, alignment becomes easier. The team no longer debates opinions; they evaluate evidence. This reduces friction and increases speed. It also improves learning. When a decision works, the company can identify why. When it fails, the company can diagnose what went wrong and adjust quickly.

For service businesses, this advantage is especially important because outcomes depend on coordination. A service company is not just selling products; it is delivering work through people, timelines, schedules, and processes. That means profitability is shaped by operational execution as much as by revenue.

Data-driven companies see the full picture: lead flow, conversion, delivery time, utilization, costs, invoicing speed, payment behavior, and customer satisfaction. This end-to-end visibility is what turns decision making into a predictable advantage instead of a constant gamble.

Which Signals Matter Most for Service Businesses

The most useful metrics are not the most complex ones. They are the ones that connect directly to growth, delivery, and cash flow. Many service businesses get trapped tracking surface-level numbers while missing the signals that actually drive profit.

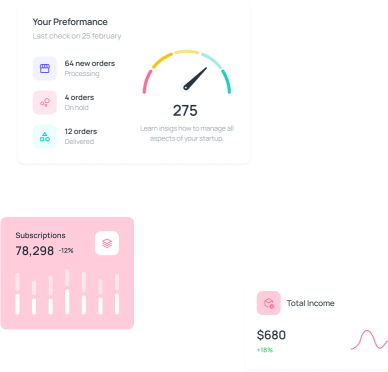

A practical set of decision signals usually includes: response time to inquiries, pipeline conversion by stage, average deal cycle length, delivery time per service type, team utilization, rework rate, project margin by category, invoice cycle time, overdue payments, and customer repeat rate.

These signals create a real operational dashboard. They reveal where the business is leaking money and where it is scaling smoothly. Most importantly, they provide early warnings. Instead of waiting for monthly results to discover issues, leaders can detect trends while there is still time to correct them.

Why Many Companies Have Data but Still Operate Blind

A common reality is that businesses have data but cannot use it. The reason is not lack of numbers. It is fragmentation. Information is spread across spreadsheets, messengers, email threads, accounting tools, project boards, and separate CRM systems. Teams spend time reconciling versions of truth instead of acting.

In fragmented environments, reporting becomes slow. By the time a report is prepared, it is already outdated. That is why many leaders stop trusting data and return to intuition. Not because they prefer it, but because their systems cannot deliver usable visibility fast enough.

The solution is not “more reports.” The solution is unified operations data: one system where sales, projects, finance, and communication are connected so that leadership sees reality in real time.

How ERP Thinking Changes Decision Quality

This is where the ERP approach matters. ERP is not only for factories or large enterprises. For service businesses, modern ERP means connecting the operational reality: clients, services, tasks, resources, costs, invoices, and outcomes. When those elements are connected, business decisions become easier because the system itself provides clarity.

Instead of asking “How are we doing?” and waiting days for answers, leaders see performance continuously. They can compare planned vs actual, identify bottlenecks, and run the business based on facts rather than assumptions.

This shift also protects teams. When the system provides visibility, employees spend less time defending themselves or explaining confusion. They can focus on executing work, improving delivery, and serving customers.

How Lua CRM Supports Data-Driven Operations

Lua CRM is designed around a simple idea: service businesses need a unified system to make good decisions at scale. That means CRM is not just sales. It includes operations, tasks, projects, finance, and reporting in one connected environment.

When data is connected, the business can measure the full lifecycle: lead to deal, deal to delivery, delivery to invoice, invoice to payment, and payment to profitability. This is the foundation of decision visibility. Instead of guessing, leadership can see what is happening and respond early.

The long-term benefit is not only better reporting. It is better behavior. When teams see the same facts, they make better daily decisions without waiting for top-down control. That is how modern companies increase speed without losing control.

Conclusion

Intuition helps businesses move fast, especially early on. But as complexity grows, intuition alone becomes a risk. Data-driven businesses outperform because they replace uncertainty with visibility, and they turn decision making into a repeatable process.

The real advantage is not having more data. It is having usable, connected signals that show reality in time to act. That is what allows service businesses to scale operations, protect profitability, and make decisions that consistently move the company forward.

.jpg)

.jpg)