Financial management plays a critical role in the success of any small business. Tasks such as invoicing, budgeting, expense tracking, and financial reporting can quickly become overwhelming when handled manually. Errors accumulate, time is lost, and important financial insights remain hidden. Financial management tools help businesses stay organized, reduce mistakes, and operate with greater confidence by providing accurate, real-time visibility into their financial health.

For many teams, these tools become essential because they automate routine work and make financial processes more predictable. Instead of sorting through spreadsheets or searching for receipts, business owners can rely on structured systems that centralize information and ensure accuracy. This allows teams to make more informed decisions and maintain better control over their operations.

Why Financial Tools Are Essential for Small Businesses

One of the biggest advantages of financial tools is the time they save. Repetitive tasks such as recording transactions, sending payment reminders, or generating invoices are completed automatically, allowing employees to focus on high-value tasks. This efficiency is especially important for small teams that handle many responsibilities with limited resources.

Another important benefit is accuracy. Human error is common when financial data is entered manually, and even small mistakes can lead to compliance issues, penalties, or flawed decision-making. Financial tools maintain clean, organized records and reduce the likelihood of errors. They also support faster tax preparation by storing information in a structured, accessible format.

What to Look for in Financial Management Tools

Small businesses should look for tools that are intuitive and easy to adopt. A clean interface and simple navigation reduce the learning curve and help teams use the system effectively from day one. Integration capabilities are also important because they allow financial tools to connect with CRM systems, payment platforms, project management tools, and other essential software. These connections eliminate the need for manual data entry and reduce inconsistencies.

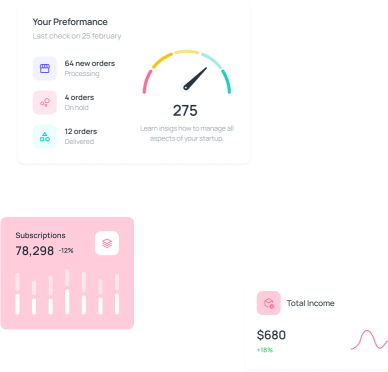

Security is another major consideration. Financial data must be protected with modern safeguards such as encryption, authentication measures, and compliance standards. Businesses should also ensure the tool offers meaningful reporting features. Dashboards and visual reports make it easy to understand key financial metrics such as cash flow, revenue, expenses, and profitability.

Types of Financial Tools Small Businesses Can Benefit From

Different financial tools serve different purposes. Invoicing and payment tools help businesses send invoices, track payments, and automate reminders. Budgeting tools assist with planning and monitoring expenses to help prevent overspending. Accounting software manages bookkeeping, taxes, and compliance. Expense tracking tools organize receipts, categorize spending, and simplify reimbursements. Additional categories include payroll software, financial reporting platforms, and loan management systems. Together, these tools form a complete financial ecosystem.

Each tool category offers unique value, and the right combination depends on the needs of the business. Some companies prefer all-in-one solutions that combine CRM, financial operations, and project management. Others choose specialized tools that excel in one specific area. Regardless of the approach, the goal is to reduce manual work, improve accuracy, and increase financial transparency.

Conclusion

Financial management tools give small businesses the ability to operate more efficiently, reduce errors, and make better decisions. By selecting the right tools and integrating them into existing workflows, companies can streamline operations and gain a clearer understanding of their financial position. This supports long-term growth and helps teams stay focused on serving customers and expanding their business.

.jpg)